Don’t Miss Out On 401k Match

August 15, 2017

Are you leaving money on the table? Capturing your entire 401k match is vital to optimal financial planning. Here are ideas for fully understanding your match, structuring your employee contributions, and implementing contribution strategies to maximize benefits.

Would you give up a 100% return on your money?

Don’t miss out on up to 100% return on your money by not optimizing your 401k contribution strategy. Calculate the best contribution level for your personal situation, monitor and adjust as needed, and ask the right questions will put you on the path for financial success. You deserve it!

Structuring Your Employee Contributions

The first priority is to make sure you receive the entire company match. For example, if your company matches the first 4% of your eligible compensation, start by contributing 4%. This company match is a 100% return on your money! In a “split” match example, you receive 100% match on first 4% + 50% match on next 2% (5% total match). Your optimal contribution should be 6% (not 5%) so that you receive the entire 5% match.

Maximizing Annual Contributions

In 2017, the maximum 401k contribution is $18,000 for employees less than age 50, and $24,000 ($18,000 + $6,000 “catch-up” amount) if you are age 50 or older. Typical payroll schedules are either twice per month (24 pay periods) or biweekly (26 pay periods).

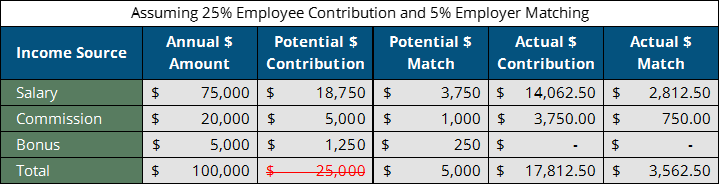

Let’s assume you are under age 50. For easy math, you earn $100,000 in eligible compensation consisting of a $75,000 base salary, $20,000 in commissions ($5,000 each quarter) and a $5,000 year-end bonus. Commissions generally have a higher tax withholding. Your cash flow allows you to contribute 25%. And your goal is to maximize 401k contributions.

At 25% contribution rate on $100,000, you think you’re on track to contribute $25,000, and receive $5000 in matching funds. Right? But wait! The IRS only allows you to contribute a maximum of $18,000 annually.

If you are not contributing, there is nothing to match!

Oops! After 9 months, you would have exceeded this limit1. Your employer typically will stop your contributions. And since there are no contributions to match, you will have left $1,437.50 free money (matching funds) on the table!

Alternative Strategy

You could contribute ONLY from salary, at the same 25% contribution level. This would max out the $18,000 annual limit when you reached $72,000 salary. However, you would miss out on $150 match from the 5% match on last $3,000 of salary.

Strategies To Monitor And Adjust

You just read this article and realize you might be missing out on receiving your entire 401k match2. What’s the solution to maximize your match?

Change your 401k employee contribution to 7.5% for the remainder of the year. You will still max out your 401k at $18,000, but you will now receive the entire $5,000 match!

Next Year…

At the beginning of next year, make your best estimate calculation for beginning of year contribution level. Using the $100,000 income example above, you would choose an 18% contribution level on all compensation sources.

To make sure you are on track to maximizing your 401k benefit, here are 7-questions you should ask, and likely answers.

Closing Thoughts

401k plans should not be a “set it and forget it” strategy. Whether you are just starting out, or have been contributing for decades, there are important strategies to consider for managing your retirement plans.

At Coherent, we provide guidance in determining your most beneficial contribution schedule, analyzing your investment choices, and building your investment allocation. See our recommended reading below!

Wishing you success,

Tom Pietrack, CFP®

August 15, 2017

You are welcome to comment!

Recommended Reading:

Managing Your 401k (DIY)

Coherent Benefits Guidance

More About 401ks

Footnotes:

- To reach the annual $18,000 maximum, your first paycheck of the fourth quarter will contribute from $750 salary at 25%, then stop. An additional $187.50 employee contribution + $37.50 match will be received. Your total contribution is $18,000 and the match you received is $3600. After 9 months, you will have earned $56,250 in salary and $15,000 in commissions for a total of $71,250. At the 25% contribution rate, you will have contributed $17,812.50 into your 401k. Part of your next paycheck will max out at $18,000. Your last 3 months of salary, final commission and year-end bonus won’t be matched.

- Let’s assume it’s the end of August. After 8 months, you have received $50,000 salary plus $10,000 in commission for a total of $60,000 in compensation. You will have contributed $15,000 into your 401k. For the remaining 4 months, you will earn $25,000 salary + $10,000 commissions + $5,000 year-end bonus, totaling $40,000. After adjusting to 7.5% contribution rate for the remaining 4 months, you will contribute an additional $3,000 and receive another $2,000 match.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF