Manager’s Letter 2016 Q2

July 5, 2016

On the flight back from my annual pilgrimage to Charlottesville, Virginia, where I volunteer with the CFA Institute, I thought it appropriate to read Thomas Paine’s Common Sense. Published in 1776, his work spoke to the common American reasoning for independence from Great Britain. In an ironic turn, 240 years later, Britons voted for independence from the European Union just days before Americans celebrate their Independence Day.

Paine argued in favor of independence from Great Britain on several points, not the least of which was economic. Peace and prosperity in the long term are inextricably dependent upon a society’s liberty, the ability of people to govern themselves locally. British voters elected independence from the European Union not on a whim, but over mounting grievances tied primarily to British sovereignty.

Europe, UK, and the Pound

The pound’s decline subsequent to the vote was heralded by some as an indication of a lack of wisdom. The currency was pounded, declining 8% against the euro in two days (the euro also declined), exacerbating the drop in UK stocks as seen internationally. But the pound has been losing ground for some time. If the two-day decline proves an exit unwise, what does declining over 40% from 2000 to 2008 say about remaining?

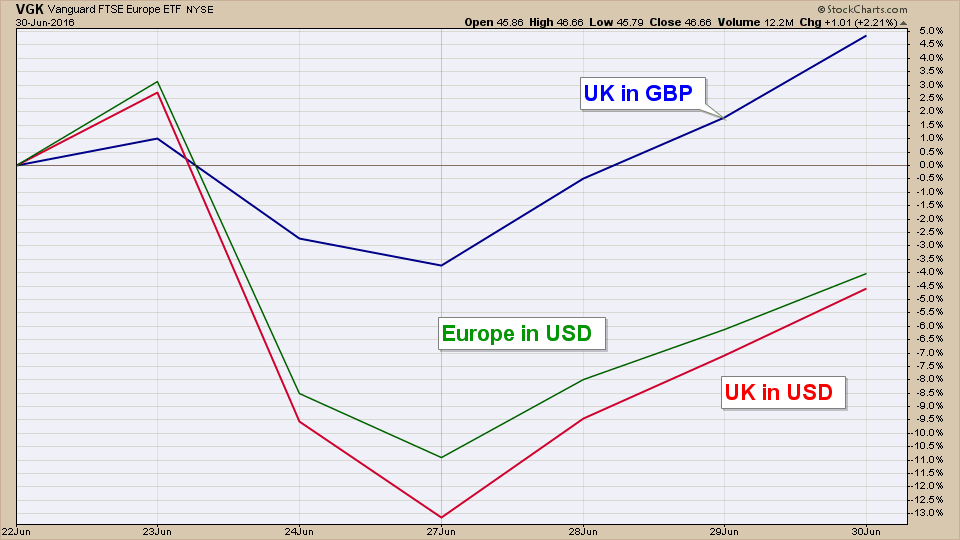

The chart in figure-1 shows the daily change in three exchange-traded funds representing…

- Europe (green) of which the UK comprises 30% by market weight

- The UK (red)

- The UK in local currency as seen by Britons (blue)

Thursday’s rally was “on news that” polls were favoring remaining. But on Friday came the vote results to exit and the media barrage of impending doom. European markets regained most of their losses in the week after the vote. What’s interesting is that over this entire period the UK markets as seen by Britons rallied 5% (figure-2).

Coherent Independence

Coherent also declared its independence six months ago, with the solemn purpose of taking care of your comprehensive financial needs without external impediments. We are accountable directly and solely to you, not to some distant and impersonal corporate office. It’s just … “common sense.”

We invite you to visit our website where we post regular articles on the Insights page, commenting on the markets and financial planning topics. There you will also find an online version of the quarterly Manager’s Letter. Please always feel free to let us know what you think. We enjoy working with you to achieve your financial independence!

Warm regards,

Sargon Zia, CFA

July 4, 2016

You are welcome to comment!

Published quarterly, the Manager’s Letter series primarily communicates the author and Chief Investment Officer’s personal opinion on the markets and other topics of interest to our clients.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF