Coherent Investor February 2016

February 7, 2016

At Coherent, we conduct our own research for managing our clients’ wealth. We compile objective data from respected sources, apply our own analysis methods, and conduct investment operations based on our own conclusions. As investment professionals, we feel we owe this to ourselves and more importantly to our clients whom we feel privileged to serve.

“The market’s top may be viewed from both the fundamental and technical perspectives. Investing with only one skill set is like watching a 3D movie with one eye closed.”

About The Coherent Investor Series

In contrast to the 300-word Manager’s Letter, the Coherent Investor series is a long-form contribution intended to benefit two audiences, the investment professional and the layman. Feel free to partake of those portions which satisfy you.

Author’s Note:

Competing priorities not of my making hindered my writing this series since April of last year. The impediment having been removed, I am looking forward to resuming the series, albeit with some pent-up supply!

The Wyckoff Market Cycle

A contemporary of such icons as Charles Dow, Jesse Livermore, and JP Morgan, Richard Wyckoff started his career on Wall Street in 1888. Among his contribution is the Wyckoff Market Cycle. Market price action reflects crowd behavior and as such may be ignored at the investor’s own peril.

Most stocks tend to conform with the overall market trend. After an extended correction, the market consolidates into a bottoming formation called accumulation, followed by a less volatile uptrend or markup period, which then ends in a topping pattern called distribution. The cycle repeats with another correction or markdown period, and so on.

Today’s Market Vis-à-Vis The Wyckoff Market Cycle

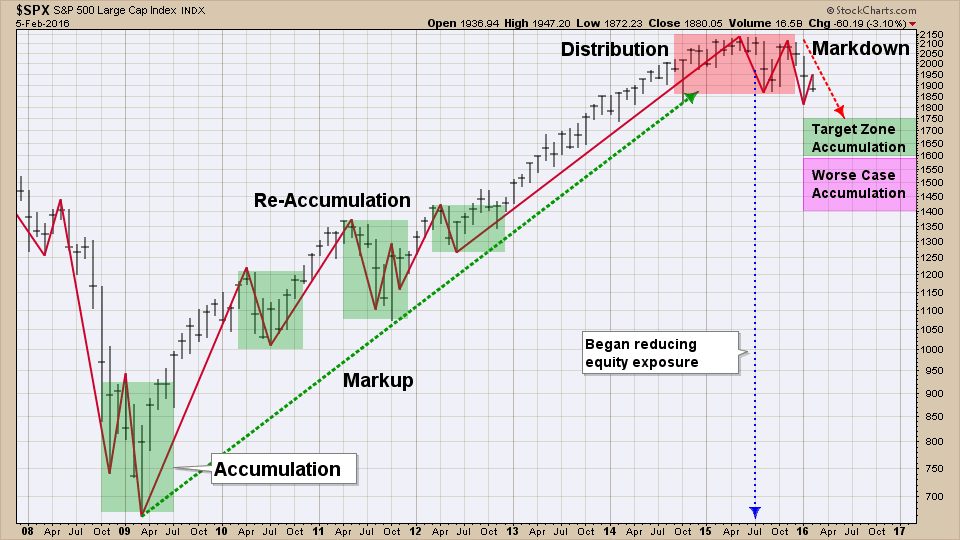

Applying the Wyckoff Market Cycle, I’ve annotated the following price chart of the S&P 500 Index from the 2009 bear market bottom through Friday’s close. I note that we are currently in Wyckoff’s “markdown” period after a distribution which has spanned about 17 months from mid-September of 2014.

In the Manager’s Letter 2015 Q3 I stated, “Cash levels have been raised and portfolios are positioned conservatively for my expectation of an S&P bottom in the 1600-1750 range, 1400-1600 worst case.” These areas are shown on the chart as the green and purple boxes at the far right. Ultimately, it will be the market which announces the end of this down-trend.

“The bull climbs up the stairs, but the bear jumps out the window.”

In my experience, market bottoms tend to be shorter and more volatile than tops. I expect this time that things will be no different. As the Wall Street saying goes…

The Market’s Distribution – Fundamentally

The market’s top may be viewed from both the fundamental and technical perspectives. Fundamental refers the study of the market’s financial health such as sales, margins, and earnings. Technical refers to the study of human behavior in relation to the supply and demand for shares. Investing with only one skill set is like watching a 3D movie with one eye closed.

“Fundamental refers the study of the market’s financial health such as sales, margins, and earnings.”

Fundamentally the market showed red flags in the last quarter of 2013. Fundamentally the market showed red flags in the last quarter of 2013. The following chart is a measure I constructed to gauge the market’s financial health using aggregate S&P 500 Index data. I first wrote about this measure in the Manager’s Letter 2015 Q2.

First let’s cover some basics about this chart:

- Green = good – price change attributable to sales growth

- Yellow = bad – price change attributable to margins growth

- Red = really bad – price change attributable to P/E expansion

Throughout most of 2014 the market’s up-trend was attributable more to earnings growth and less to P/E ratio (yellow), the price paid for each dollar of earnings. This is good until a closer look reveals that earnings rose primarily due to increasing margins (red), i.e. reducing costs, and less due to increasing sales (green).

The Effect of Sales and Margins On Earnings

Sales growth has been anemic really this whole 2009 bull market, especially relative to prior recoveries. Then sales growth turned down sharply in 2015. Meanwhile margins, perhaps the most cyclical or mean-reverting of market series, had been running at maximum. There’s just so much blood you can squeeze from the expenses turnip. When both turned south, there was nothing earnings growth could do but follow. We’ve been sharing much on this topic in recent quarters. Now here we are.

The effect can be seen on S&P operating earnings growth rate estimates throughout 2015 as demonstrated by the following charts. Fiscal 2015 estimates have dropped nearly 20% from $131 per share to less than $106. Full year 2015 earnings growth estimates are down from a positive 12% at the start of that year to a negative 6.5% contraction as of month-end January 2016.

The Market’s Distribution – Technically

The market’s fundamental deterioration reflected discernibly in the behavior of major market averages such as the S&P 500 Index. There are numerous measures to illustrate this point but I will show you two: first sector leadership rotation, then price topping behavior.

“Technical refers to the study of human behavior in relation to the supply and demand for shares.”

Calendar year 2013 has been the best so far in the 2009 bull market. Defensive sectors like utilities and staples lagged behind the major average while cyclicals, industrials, and financials lead. Technology, often a leader in bull markets, lagged. Compare 2013 sector leadership above to that of 2014 below. Utilities which lagged in 2013, lead in 2014. Utilities?

By my measure Wyckoff’s distribution period started in mid-September 2014. Sector leadership has not changed much in the 17 months since September to date.

Price Topping Behavior

As sector leadership was turning defensive, so was the price action of major indices like the S&P 500 Index shown in the chart below. The green dashed line (green good) describes the uptrend in equities from the 2011 correction. This trend was broken in mid-2015 but not before the market issued several other technical warnings.

The area in blue is one of the measures I use to describe market “breadth”, or participation as I prefer to call it. As the market retested highs in July, participation notably declined. This was one of several reasons we began reducing equity exposure on July 15, 2015. In fact, this divergence has been exhibited during new highs since the September 2014.

The November rally, as tempting as it was, did not suck us back into the market (hence “Hoover” rally). Our reasons at the time included a lack of sector and stock leadership, and deteriorating market participation. Note that the divergence in participation was even more pronounced at the November highs, yet another red flag.

Inflation And The Price-Earnings Ratio

When fundamentals deteriorate, what accounts for market prices rising? Inflation. The same kind of inflation which you pay at the grocery store, investors pay in the stock market. When we pay higher stock prices for the same dollar in earnings, that’s a kind of inflation referred to as a rising P/E ratio, or price/earnings ratio.

The forward P/E ratio (red line, chart below) had been rising since late 2012 until it broke above the prior bull market’s peak in 2014. A rising P/E ratio in the absence of commensurate growth denotes market price inflation. S&P 500 quarterly operating earnings are represented by the blue bars, and index price by the lighter blue area.

About I, We, and “We”

In our industry it is common for portfolio managers to refer to themselves as “we” rather than “I”, even when they are singularly responsible for portfolio management decisions. I don’t know why this is so. Maybe it’s etiquette, maybe it’s something else. Until I figure it out I will tend to switch between the two in my writing.

An article came my way recently in which I read a usage of “we” which I found troubling. Referring to constructive actions taken by its firm’s former lead portfolio manager to protect portfolios, the article bestowed the credit upon the incoming administration which was not even in place at the time, all with the simple word, “we”.

I suppose this portfolio manager would like to extend his gratitude to them for “validating our initiative to pare back risk beginning last summer,” but the article cites no specific author. Or perhaps the recognition, if not gratitude, should have gone the other way?

We, that is to say Tom Pietrack and I, at Coherent Financial Advisers thank you, our clients, for your trust in allowing us the privilege of taking care of your financial well-being.

Warm regards,

Sargon Zia, CFA

February 7, 2016

You are welcome to comment!

Published regularly, the Coherent Investor series focuses on the current conditions of the securities markets as interpreted by the author and Chief Investment Officer, unifying multiple investment disciplines including fundamental and technical analysis.

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF