Financial Planning Timeline

February 15, 2016

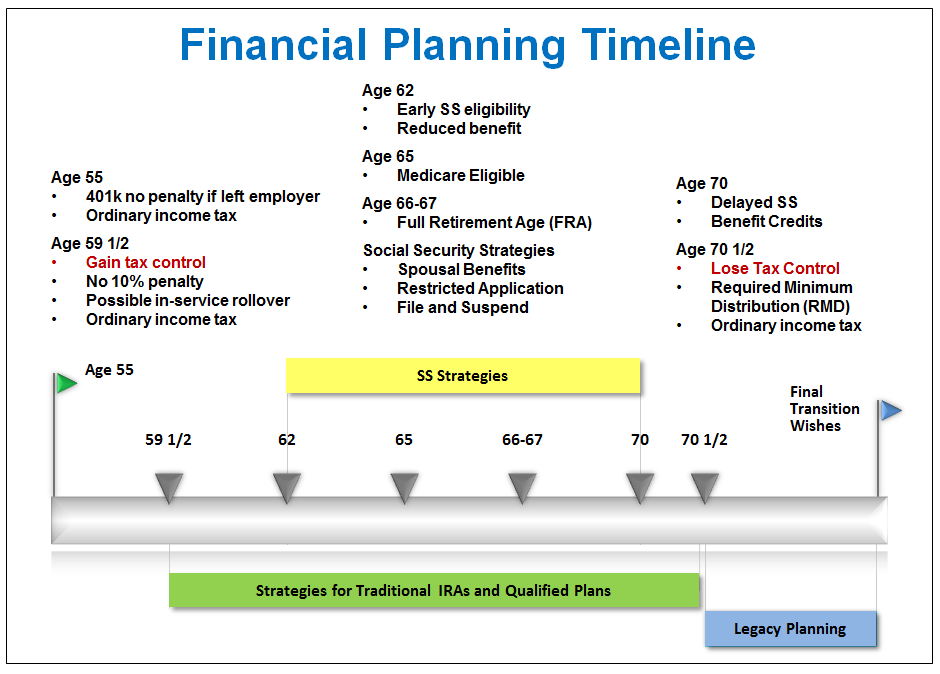

The financial planning timeline helps to identify potential strategies to prepare an efficient and effective plan. While individuals and families have unique financial goals and circumstances, these key dates provide a framework to help make better informed financial planning decisions.

Traditional Strategy Using Employer Plans

Our working lives provide an accumulation phase where earned income is taxed (federal, state, local, FICA, Medicare etc.). Traditional planning strategies typically focus on reducing current taxation by saving as much as possible within tax deferred vehicles, predominately traditional IRAs, 401k, 403b or other qualified employer retirement plans.

If your employer provides a matching contribution in the 401k for example, then it certainly makes financial sense to contribute at least as much to earn the entire company match. Traditional planning then recommends the continuation of tax deferral as long as possible.

Tax Deferral May Result In Higher Taxes At Retirement

Let’s take a moment to review the definition1 of “defer” – to put off (action, consideration, etc.) to a future time. Other synonyms include: postpone, delay and suspend. So the action of deferral does not reduce the tax consequences, but merely delays them.

Conventional thinking assumes that people will be in a lower tax bracket in retirement since they will no longer be receiving a salary/income at the level earned during their working career. However, income is taxable from retirement income sources such as pensions, deferred compensation and traditional IRA/401k/qualified retirement plan withdrawals. In addition, up to 85% of your Social Security benefit may be taxable. Thus we are finding that when people retire, they may not be in a significantly lower tax bracket.

Making Tax Deferral Most Beneficial

For tax deferral to be most beneficial, future taxation must be at the same or a lower level. The first question that needs to be considered is, “Where do you think tax rates will be in the future – lower, the same or higher?”

Financial planning strategies can then be designed considering your human capital, effective use of workplace benefit programs, proper investment diversification and risk management and asset “location” to integrate tax efficiency.

“The action of deferral does not reduce the tax consequences, but merely delays them. Thus we are finding that when people retire, they may not be in a significantly lower tax bracket.”

The Financial Planning Timeline

At age 59 ½, you gain a measure of tax control. The 10% early withdrawal penalty from traditional IRAs and qualified retirement plans goes away. Note: There is another possible exception to the 10% early withdrawal penalty for 401k plan distributions2 “made to a participant after separation from service if the separation occurred during or after the calendar year in which the participant reached age 55.” Typically, clients are still working until sometime past age 59 ½. Therefore, it doesn’t make sense to add ordinary income taxation from 401k plan withdrawals while receiving earned income.

Social Security Optimization Strategies

Age 62 begins eligibility for early Social Security benefits (age 60 for qualifying widow or widower). Delaying until age 70 provides the potential for enhanced SS benefits. Your benefit is based on your Primary Insurance Amount (PIA) calculated from your contributions into Social Security.

Receiving early SS benefits creates a reduction based on each month’s retirement prior to “Full Retirement Age” (FRA). Assuming FRA is age 66 (for those born between 1943 and 1954), receiving your SS benefit when just reaching 62 would incur a 25% permanent reduction in benefits. Let’s also review reaching FRA, for example, at age 66.

Once you have reached FRA, there is no reduction in SS benefits, including no reduction if you continue working and earning income. You can also choose to delay SS benefits until age 70. For each full year past FRA, you will receive an 8% increase in the benefit calculation. If FRA is age 66, and benefits are delayed to age 70, you would receive a permanent 32% increase in benefits.

There are many considerations when reviewing Social Security strategies for individuals and spouses. Recent changes to Social Security rules for 2016, including file and suspend, and restricted application make this an important aspect of financial planning.

Medicare Coverage

Another important date occurs at age 65. This milestone provides eligibility for Medicare coverage in normal circumstances. Those retiring prior to age 65 must incorporate the cost of securing health care coverage into their planning. Health care premiums needed to bridge the years prior to age 65 can be a significant financial burden.

Required Minimum Distributions Considerations

The final milestone is age 70 ½ when you lose some degree of tax control due to the Required Minimum Distribution (RMD). You must take distributions at ordinary income tax rates of at least a certain portion from your tax-deferred plans under normal circumstances. The RMD life expectancy factor is based on your age and typically over time, your distribution will become a larger percentage (Note: there is a special table for married couples where one spouse is greater than 10 years younger).

Individuals with large traditional IRA and 401k balances may be surprised by the tax burden when experiencing RMD, especially in later years. The penalty for not taking at least the minimum distribution is especially onerous – a 50% penalty!

Information Versus Wisdom

There is a hierarchy of investment and tax strategies to consider that can help control your overall lifetime taxes, especially as you approach ages 59 ½ to 70 ½. Financial planning isn’t just about the numbers. Many people have specific legacy planning wishes, including a desire to leave assets for family, loved ones or charitable inclinations.

At Coherent Financial Advisers, we find that people are not merely looking for more information, but financial wisdom. We look forward to organizing the many complex moving parts of your financial lives into a coherent plan, providing the calm, clarity and harmony you deserve!

Best Regards,

Tom Pietrack, CFP®

Director of Financial Planning

February 15, 2016

- http://dictionary.reference.com/browse/defer

- www.irs.gov 401(k) Resource Guide – Plan Sponsors – General Distribution Rules

CONTACT US FOR A COMPLIMENTARY CALL

We look forward to discussing your unique financial goals and personal values!

GET STARTED

Print PDF

Print PDF